Watch your savings grow

The Board of Directors are guided by Savings & Loan Society Act 2015, the Constitution of TISA, Prudential Standards of the Central Bank, Board Charter and other applicable regulatory provisions.

The Bank of Papua New Guinea (regulator) sets the minimum competencies regarding personal attributes, skills and knowledge that each director should bring to the Society.

The Governor of the Bank of Papua New Guinea may undertake relevant skills gap analysis to ensure that the Board has the right mix of skills.

Board Members are then required to be assessed by the Governor of the Bank of Papua New Guinea with regards to these minimum competencies.

This “Fit and Proper” frame work deals with matters such as Minimum Competency, Director Development, Independence, Director Refreshment & Renewal and Performance.

The Board is made up of Non Executive and Independent Directors

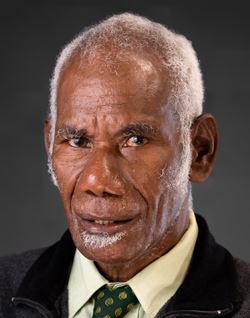

Gabriel Tai

Chairman

William Varmari

Director

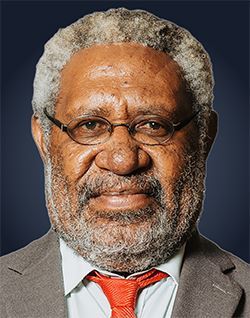

Michael O. Koisen, OBE ML

Director

Simon Woolcott

Independent Director

Lucy Sabo-Kelis

Independent Director

Dr. Peter Mason

Independent Director

The Board is required to have extensive business acumen to bring accountability and sound judgement to the Board’s deliberations to ensure optimum benefit to members, employees and the wider community.

Review Board of Directors Code of Conduct here

Michael O. Koisen, OBE ML

TISA Group Chief Executive Officer

Luke Kaul

Chief Operating Officer

Kumaresh Chithravelu

Chief Financial Officer

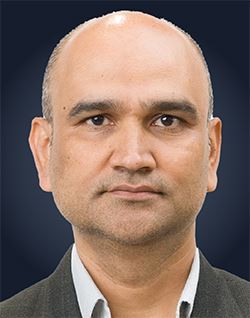

Samit Kumar Bhatnagar

Chief Information Officer

Philip Hehonah

Company Secretary

Sachin Rayamajhi

Chief Risk Officer

John Simango

CEO - TISA Foundation